Quick Take

Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) accumulated an impressive $948.3 million over five consecutive trading days. This remarkable streak marks the first time such a feat has been achieved from March 11 to March 15.

Bitcoin ETF Flow Table: (Source: Farside)

Farside data shows that on May 17 alone, the BTC ETFs witnessed a staggering $221.5 million in net inflows, with eight out of the 11 ETFs recording positive inflows. Fidelity’s FBTC led the charge, attracting $99.4 million, bringing its total net inflows to a remarkable $8.5 billion. BlackRock’s IBIT followed closely, with a $38.1 million inflow, taking its total net inflows to $15.6 billion. Grayscale’s GBTC also continued its positive momentum, recording a $31.6 million inflow, marking its third consecutive day of inflows. Despite this, GBTC’s total outflows stand at $17.6 billion. Collectively, the ETFs have amassed a net total of $12.6 billion.

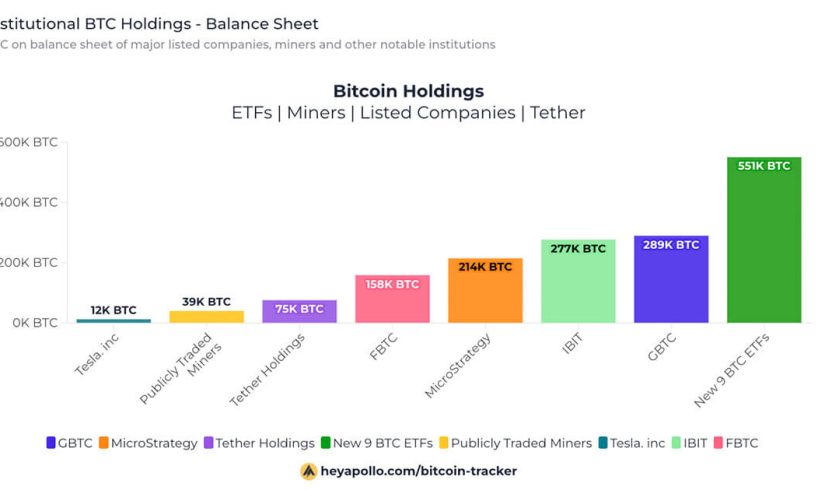

According to data from heyapollo, the nine new BTC ETFs have surpassed 550,000 BTC in holdings, while Grayscale’s GBTC holds roughly 289,000 BTC.

Bitcoin Holdings: (Source: Heyapollo)

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.